Chapter 2 Theories of Balance of Payments

Lead-in

Reserve’s assets shrank for the first time since February 2020, reflecting a sharp drop in currency swaps with foreign central banks and a continued slackening in demand for other emergency credit facilities.

The Fed’s balance sheet—composed of assets ranging from U.S.Treasury bonds and mortgage-backed securities (MBS)to loans to banks and state governments—fell to $7.14 trillion on June 17, 2020 from $7.22 trillion a week earlier, Fed data released on Thursday showed.It was the first decline since the end of February, just before the Fed slashed interest rates to near zero and kicked a bevy of emergency credit facilities into overdrive to soften the economic blow from the coronavirus pandemic and the recession it has since triggered.

The $74.2 billion decline, the largest weekly drop since 2009, was driven by a $92 billion drop in foreign exchange swaps with other central banks to $352.5 billion on Wednesday from $444.5 billion a week earlier.The total amount outstanding in the swap lines, designed to ease a surge in demand for U.S.currency in the participating banks’ jurisdictions during the early weeks of the crisis, was the lowest since early April.

TD senior U.S.rates strategist Gennadiy Goldberg said in a research note that the swap decrease may have been driven by banks making room for cheap loans known as TLTROs, or because they are able to fund elsewhere.The European Central Bank on Thursday announced record take-up of its new round of TLTROs, which stands for targeted longer-term refinancing operations.

Together with softening demand for a number of other emergency credit programs, that offset an increase in purchases of Treasuries and mortgage-backed securities.The Fed’s stash of Treasuries rose by nearly $19 billion to a record $4.17 trillion, while it added $83.1 billion in MBS, the most in five weeks, for a total of $1.92 trillion.

The data showed that the Fed has not embarked on a massive corporate bond purchasing spree since tweaking its Secondary Market Corporate Credit Facility (SMCCF)to set up direct bond purchases in addition to shares of bond exchange traded funds (ETF).The facilities’ assets rose by $1.5 billion to $38.9 billion from a week earlier.More than 80% of the assets in the SMCCF are the Treasury Department’s seed money.It has acquired just over $7 billion of corporate bonds or bond ETF shares since it launched several weeks ago.

Source: Reuters, June 18, 2020, https://money.usnews.com/investing/news/articles/2020- 06-18/us-feds-balance-sheet-shrinks-for-first-time-since-february

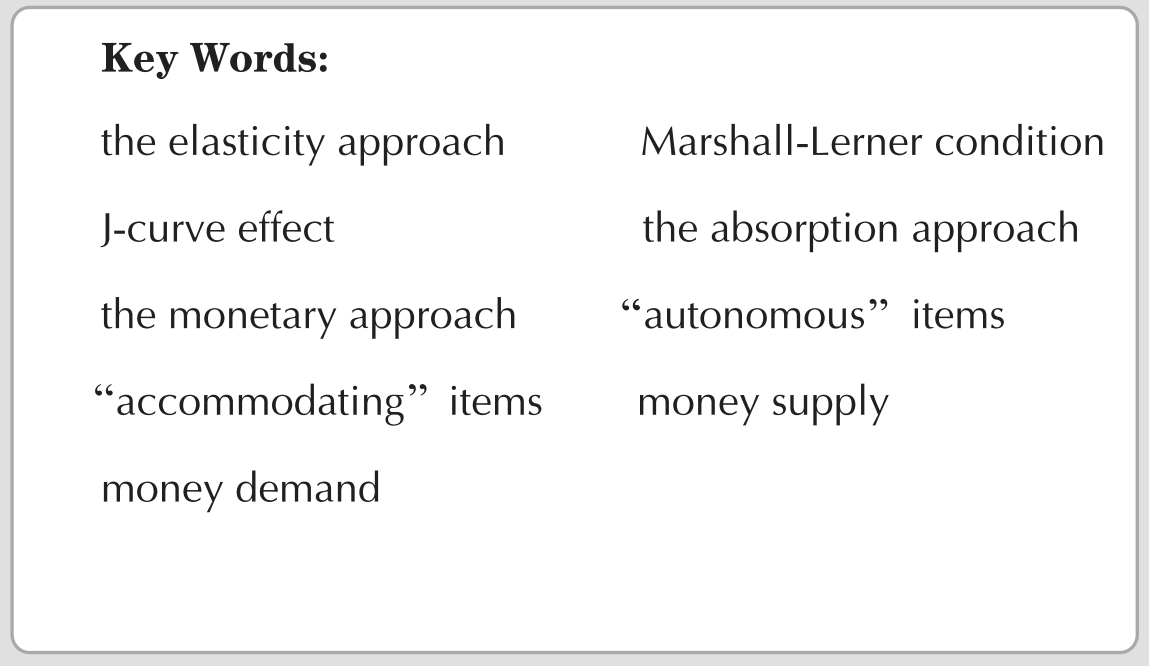

We start the chapter by examining the impact of exchange-rate changes according to the elasticity approach, assuming domestic and foreign prices are fixed.This is followed by an analysis of the absorption model which examines the effects of exchange-rate changes in terms of their impact on domestic income and spending.The chapter concludes by analyzing the similarities and differences between the two models.To put it simply, throughout this chapter we shall ignore the complications of unilateral transfers and interest, profit and dividends on the current account balance, and concentrate on the export and import of goods and services.The exchange rate is defined as domestic currency units per unit of foreign currency, so that a devaluation/depreciation of the currency is represented by a rise in the exchange rate.